Navigating Home Construction Loans: Tips for Financing Your Project with BricknBolt

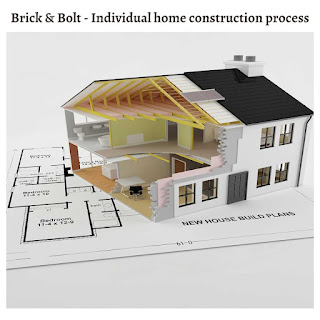

Constructing a custom home allows you to create a space that perfectly fits your lifestyle and preferences. However, financing a home construction project can be a complex process. With the right approach, you can secure the funding you need to bring your vision to life. In this blog, we’ll explore some essential tips for navigating home construction loans, focusing on partnering with BricknBolt, a reputable home construction company.

Understand Your Financial Options:

Establishing a realistic budget tops the list before embarking on home construction. Evaluate the maximum amount you can allocate, considering land purchase, building expenses, permits, and potential unforeseen costs. Bricknbolt Jaipur seasoned experts guide you through creating a well-planned budget that accounts for all costs, including materials, labor, and permits. By planning ahead and budgeting wisely, you can avoid potential cost overruns and ensure that your project stays on track financially.

Research Loan Options:

Numerous loan options exist for funding home construction endeavours. These include construction-to-permanent financing, which transitions into a conventional mortgage upon completion, and standalone construction loans, necessitating separate financing for the building phase and mortgage. By consulting BricknBolt Gurgaon’s knowledgeable team, you can gain insights into the advantages and disadvantages of each financing avenue, enabling you to select the option most closely aligned with your objectives.

Work with Trusted Partners:

Securing financing for a substantial investment demands trust and dependability as top priorities. By collaborating with reputed banking institutions like HDFC Home Loans, SBI Home Loans, and Sundaram Finance, Brick&Bolt ensures that customers receive outstanding service and assistance throughout the loan journey. These trusted partners boast an exceptional reputation for excellence in the financial realm, granting customers the assurance that their financing requirements are managed by competent professionals.

Explore Competitive Interest Rates:

One of the most significant advantages of working with Brick and Bolt Chennai is access to competitive interest rates on home construction loans. Clients can discuss with Brick and Bolt Mysore to know about attractive interest rates. Before committing to a loan, it’s essential to shop around and compare interest rates from different lenders to ensure you’re getting the best possible deal. Bricknbolt Faridabad team can assist you in evaluating your options and choosing the loan with the most favorable terms.

Stay Informed Throughout the Process:

Getting financing for building a new home involves various steps, but you don’t have to manage it alone. Throughout the loan application and construction phases, BricknBolt’s experts guide and assist you. You can count on them to clearly explain loan terms, paperwork needed, and construction schedules. They keep you informed and empowered during the entire process, ready to address any queries you may have.

Conclusion:

By following these tips and partnering with BricknBolt, you can confidently navigate the home construction loan process. The company has garnered positive Brick and Bolt reviews from its clients. From securing financing to completing the build, their team will work tirelessly to bring your vision to life and deliver a custom home that exceeds your expectations. Get started on your home construction journey today and turn your dream home into a reality.

Comments

Post a Comment